The external reserves have seen a significant rise, reaching $34.11 billion as of March 7, 2024, the highest level in eight months

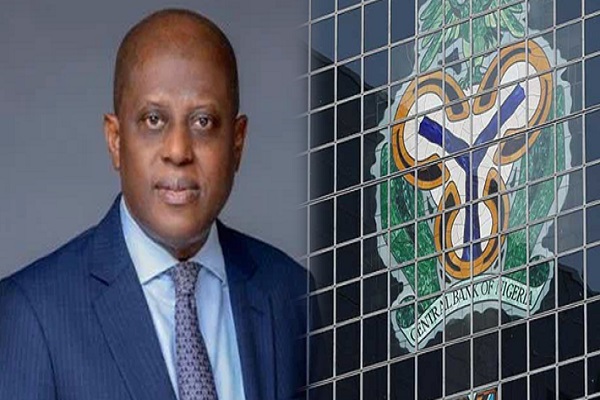

The Central Bank of Nigeria (CBN) has settled the $7 billion foreign exchange (FX) backlog inherited by Governor Yemi Cardoso.

This move fulfills a key pledge on his appointment and signifies a significant step towards restoring confidence in the economy.

In a statement on Wednesday, CBN’s Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali, confirmed settlement of all valid FX backlog claims.

The CBN, she said, employed Deloitte Consulting, an independent auditing firm, to meticulously assess the transactions, ensuring that only legitimate claims were honoured.

“Any invalid transactions were referred to the relevant authorities for further investigation,” she stated.

The CBN’s commitment to tackling the FX backlog appears to be paying off.

External reserves have seen a significant rise, reaching $34.11 billion as of March 7, 2024, the highest level in eight months

This month-on-month increase is attributed to a notable rise in remittance payments from Nigerians abroad and increased foreign investment in local assets, including government debt securities.

The CBN’s actions are part of a broader strategy outlined during the last Monetary Policy Committee (MPC) meeting.