‘Thank you’… Customers Hail Zenith Bank For Restoring Full Service On All Payment Platforms

Part of the gains of the IT upgrade that has seen improved services on Zenith Bank’s channels, including Zenith debit cards, Zenith Bank mobile app, Zenith Bank internet banking platform, and Zenith agents nationwide

With Dame Adaora Umeoji as Chief Executive Officer, the prominent financial institution Zenith Bank has restored full services on all its payment platforms.

Customers across different social media platforms have confirmed the development.

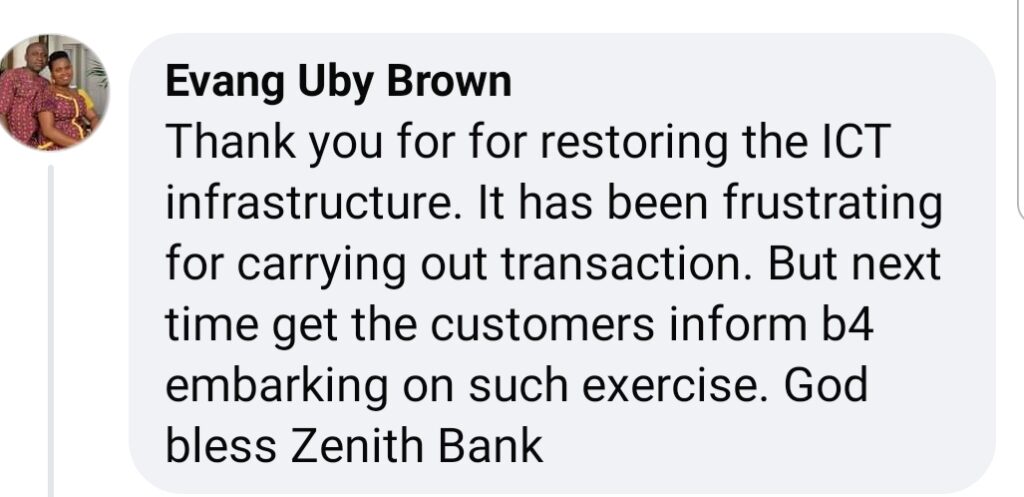

“Thank you for restoring the ICT infrastructure. It has been frustrating for (sic) carrying (sic) out transaction (sic). But next time, get the customers inform (sic) b4 embarking on such exercise (sic). God bless Zenith Bank,” an account holder with the social username “Evang Uby Brown” commented on the industry leader’s continuing announcement of restoring full service in a Facebook post on Thursday, October 10, 2024.

The telling was part of the nation’s most profitable bank’s comprehensive awareness of the return of improved services on all its digital payment assets that started on Thursday, October 3, 2024.

The development came on the heels of a disruption of services during the IT system upgrade, which aligns with the bank’s popular taglines “ZenithCares” and “InyourBestInterest.” Read More

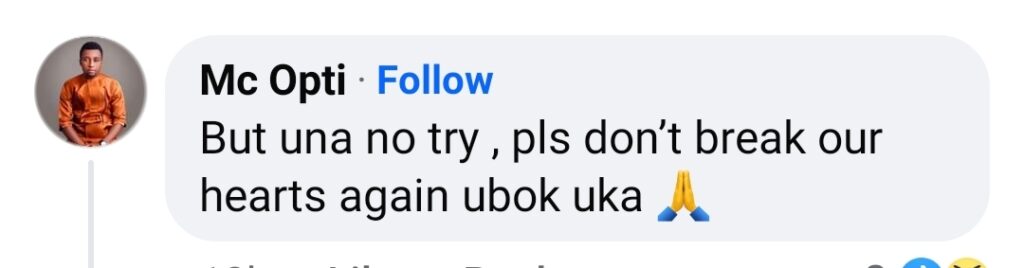

“But una no try, pls don’t break our hearts again ubok uta,” another customer with the user profile Mc Opti validated the restoration of full services and the value placed in the bank’s offerings.

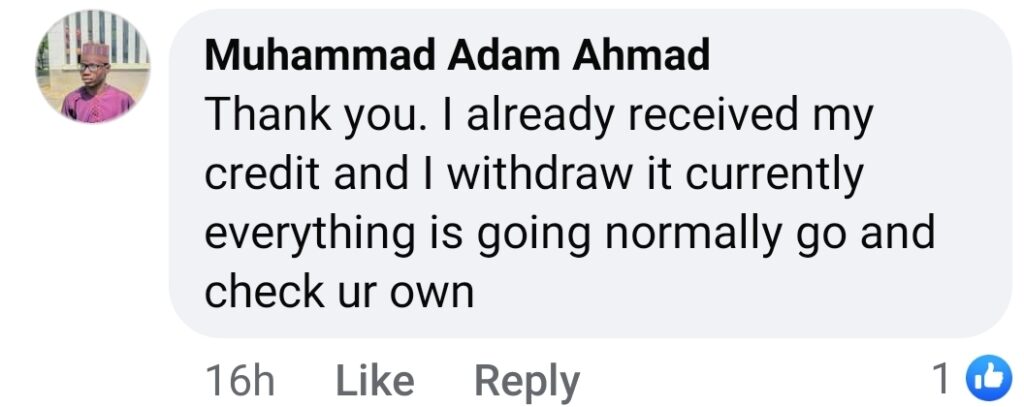

“Thank you, I already received my credit and I withdraw (sic) it. Currently, everything is going normally. Go and check your own,” Muhammad Adam Ahmad made another confirmation while urging other customers to self-check on another sensitization post made by Zenith Bank on Friday, October 11, 2024. Read more

These comments are part of the growing validation of the return of full service to all the digital platforms of Nigeria’s number one bank by Tier-1 capital for the past fifteen years.

Checks revealed that although Zenith Bank is at the forefront of the digital transformation—IT system upgrades that elevate efficiency and boost cybersecurity—it is an inevitable move for all other players in the banking industry.

By embracing financial technology, the banking industry has grown exponentially, and banks are taking steps to position themselves to serve customers better properly. And IT upgrade and service disruption are Siamese twins—you can’t do one without the other. A major gain of Zenith’s exercise is that it is done with, and customers are now reaping the gains. For customers of other banks, they don’t even know what they would go through in a process that is sure to come,” industry experts pointed out.

Part of the gains of the IT upgrade that has seen improved services on Zenith Bank’s channels, including Zenith debit cards, Zenith Bank mobile app, Zenith Bank internet banking platform, and Zenith agents nationwide (Agent Banking), include more user-friendly and seamless operations, better protection of customers’ data (boosted cybersecurity), enhanced self-service efficiency, better access to banking services—irrespective of time and place—optimized transaction speed for transfers, payments, account enquiries, and others. Continue Reading