UBA CEO Oliver Alawuba has pledged $150m to Kenya’s Roads Levy Securitization Program during a high-level visit to President William Ruto, reaffirming the bank’s commitment to infrastructure, SMEs, and sustainable growth

UBA Pledges $150m to Kenya’s Roads Project as CEO Oliver Alawuba Meets President Ruto

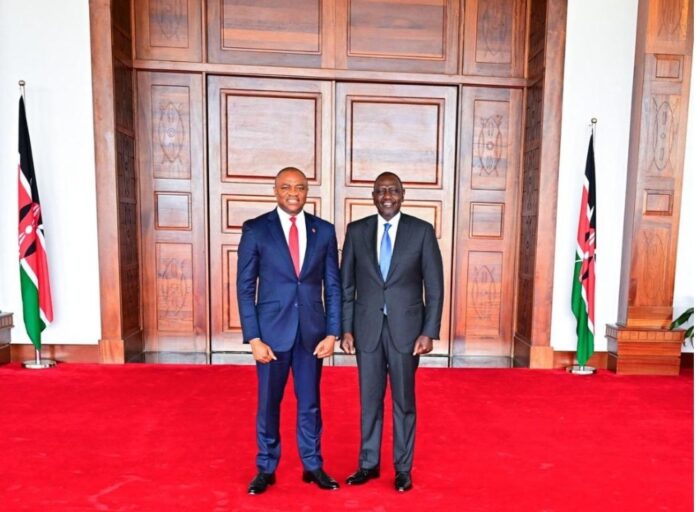

The Group Managing Director/Chief Executive Officer of United Bank for Africa (UBA) Plc, Oliver Alawuba, on Tuesday led a high-powered delegation on a working visit to Kenya, where he reaffirmed the bank’s commitment to accelerating investment and supporting inclusive growth in the country.

Alawuba, who was received at the State House Nairobi by President William Ruto, was commended for UBA’s longstanding support to Kenya’s economic development. Discussions centered on infrastructure development, financing small and medium-sized enterprises (SMEs), and supporting Kenya’s long-term economic transformation agenda.

“Kenya holds a strategic place in Africa’s growth story, and UBA is committed to being a long-term partner in unlocking the immense potential here,” Alawuba said. “From financing critical infrastructure to empowering SMEs that drive job creation, our mission is to deliver sustainable solutions that connect markets, foster trade, and improve lives.”

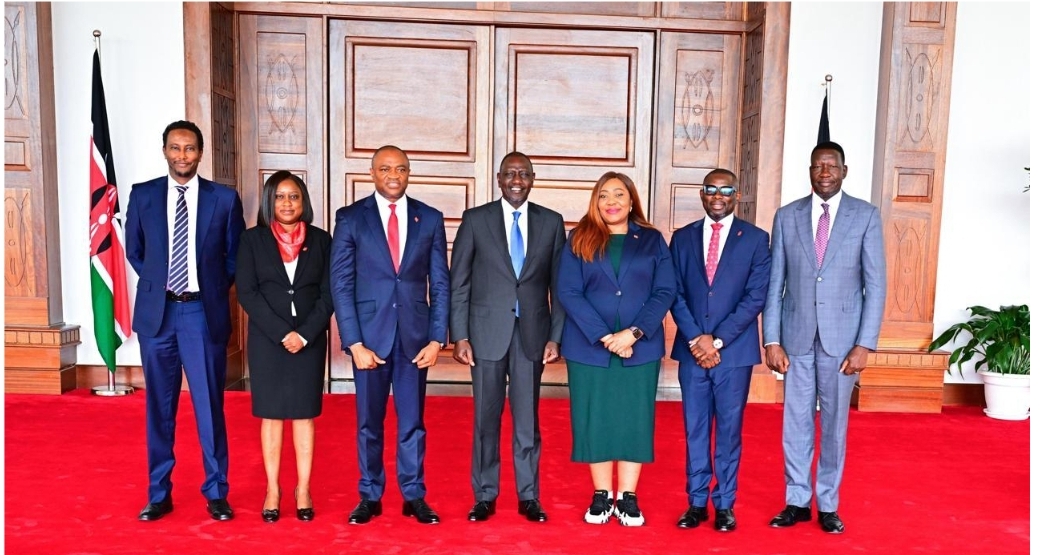

Alawuba was accompanied by Sola Yomi-Ajayi, Executive Director/CEO of UBA Africa, and Mary Mulilu, Managing Director/CEO of UBA Kenya. The team also held high-level talks with key financial sector leaders, including Dr. Kamau Thugge, Governor of the Central Bank of Kenya, on strengthening financial sector resilience, enhancing cross-border payments, and reinforcing UBA’s strong capital base in the country.

In a landmark announcement, UBA pledged USD 150 million (KES 20.5 billion) to Kenya’s Roads Levy Securitization Program, a USD 1.35 billion initiative spearheaded by the Kenya Roads Board. The program, unveiled during a meeting with Roads and Transport Cabinet Secretary Davis Chirchir, seeks to upgrade critical road infrastructure, accelerate contractor payments, and enhance national connectivity.

“Infrastructure is the engine of trade, competitiveness, and shared prosperity,” Alawuba said. “UBA is proud to be one of the largest financiers of this program, demonstrating our unshakeable confidence in Kenya’s future.”

Mary Mulilu, UBA Kenya CEO, added, “Our participation cements UBA’s role as a trusted ally to the Kenyan government, businesses, and communities. We are paving the way for better connectivity that empowers farmers, manufacturers, and SMEs across the country.”

The delegation also met with Prime Cabinet Secretary Musalia Mudavadi, where discussions highlighted the role of African-led enterprises in creating jobs, fostering innovation, and driving sustainable growth.

“These engagements reaffirm UBA’s commitment to collaborate with governments and stakeholders in building a prosperous, united, and self-reliant Africa,” Alawuba noted.

UBA’s engagements in Kenya align with its broader strategy of driving economic transformation across Africa, with Kenya positioned as a vital hub for regional integration under the African Continental Free Trade Area (AfCFTA). With SMEs contributing over 80% of Kenya’s employment, the bank is rolling out tailored financing solutions to strengthen entrepreneurship and unlock opportunities.

United Bank for Africa, known as “Africa’s Global Bank,” operates in 20 African countries, as well as in the United Kingdom, the United States, France, and the United Arab Emirates. With over 25,000 employees and more than 45 million customers worldwide, UBA remains one of Africa’s largest and most influential financial institutions. Read More