Peter Obi blasts alleged discrepancies in Nigeria’s tax laws, claiming forgery after Tinubu’s 2026 budget presentation. He warns of threats to constitutional governance and demands transparency on alterations

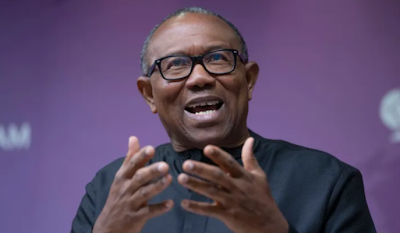

Peter Obi Accuses FG of Forging Laws Amid 2026 Budget Presentation: Tax Reforms Under Fire

Former Labour Party presidential candidate Peter Obi has sharply criticized the Federal Government, accusing it of allowing post-passage alterations to key tax reform laws—describing the shift as moving from “padded budgets to forged laws.”

Obi’s scathing statement, titled “Migrating from Padded Budgets to Forged Laws,” was posted on his X account on Saturday, December 20, 2025—one day after President Bola Tinubu presented the 2026 Appropriation Bill to the National Assembly.

The controversy centers on four major tax reform acts signed by President Tinubu in June 2025: the Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act, and Joint Revenue Board (Establishment) Act. These laws, set to take effect January 1, 2026, have sparked outrage after allegations that the gazetted versions differ from what the National Assembly approved.

Obi highlighted “documented discrepancies” between the legislature-passed bills and the executive-published laws, warning that such changes undermine constitutional governance and erode public trust.

“Our national shame continues to unfold, evident in the decisions made by our leaders, even at the highest levels of government. This shame is highlighted by a deeply troubling—and frankly unacceptable—issue: the documented discrepancies between what the legislature passed and what was ultimately published as law by the executive.

“This is not merely an administrative oversight; it is a serious matter that strikes at the core of constitutional governance and reveals the extent of our institutional decay.

“We have transitioned from a Nigeria where budgets are padded to one where laws are forged—changes that impact taxpayers’ rights and, most importantly, access to justice.

“Even more alarming is the introduction of new enforcement and coercive powers that the House of Representatives never approved. These include an outrageous requirement for a mandatory 20% deposit before appeals can be heard in court, asset sales without judicial oversight, and the granting of arrest powers to tax authorities.

“Perhaps most disturbing is the silence of the Presidency on a matter involving allegations of forgery, institutional sabotage, and abuse of process. Who made these alterations? All of this must be made public.

“Nigerians need to understand what was signed, what was passed, and what was formally recorded. We cannot continue to ask citizens to pay more taxes while trust in governance collapses.

“We need leadership that follows due process, embraces transparency and accountability, and respects the rule of law. No nation can thrive where laws are forged, and silence replaces leadership,” Obi wrote.

The allegations echo concerns raised by House of Representatives member Abdussamad Dasuki, who prompted the formation of an ad-hoc committee to investigate the discrepancies. Opposition figures, including the African Democratic Congress (ADC), have called for suspending the laws’ implementation pending review.

Meanwhile, President Tinubu’s 2026 budget proposal—titled “Budget of Consolidation, Renewed Resilience and Shared Prosperity”—pegs total expenditure at ₦58.47 trillion, with capital spending at ₦26.08 trillion, debt servicing at ₦15.52 trillion, and a deficit of ₦23.85 trillion (4.28% of GDP). It assumes 1.84 million barrels per day oil production, $64.85 per barrel benchmark, and ₦1,400/$ exchange rate.

Obi’s statement has amplified calls for accountability, as Nigeria grapples with fiscal reforms amid economic challenges. The Presidency has yet to respond directly to the forgery claims but has defended the tax laws as vital for revenue modernization. Read More