Lagos State Governor, Babajide Sanwo-Olu, has reiterated his administration’s commitment to the establishment of the Lagos International Financial Centre (LIFC), urging sustained collaboration between public and private sector stakeholders to position Lagos as a globally competitive financial hub.

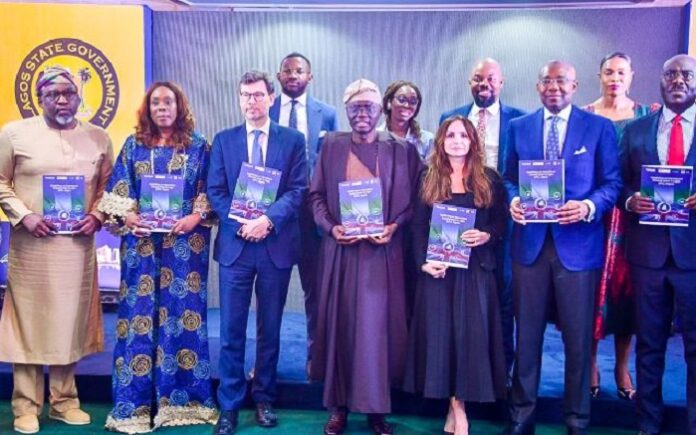

The governor spoke at the unveiling of the LIFC Phase 1 Report held at the Lagos State House, Marina, where he described the initiative as a strategic economic reform aimed at strengthening Nigeria’s global competitiveness and transforming Lagos into a leading international financial centre.

Chairman of the Lagos International Financial Centre Council (LIFCC), Sanwo-Olu said the project, conceived about two years ago, was designed to attract international capital, deepen financial markets and generate sustainable economic opportunities for Nigeria.

According to him, the success of the initiative is anchored on a clear long-term vision, strong institutional backing and sustained stakeholder support.

“For me, it is all about leadership and confidence. If you can dream it and envision it, then you can achieve it. The foundation we are laying today is for the future of our economy, our children and generations to come. This is not just about Lagos; it is about building an economic legacy that will transform Nigeria’s financial ecosystem,” the governor said.

Sanwo-Olu noted that significant groundwork had already been completed through policy engagements, technical partnerships and institutional capacity building, adding that the next phase would focus on implementation and structural reforms.

He commended the United Kingdom government and TheCityUK for providing technical and financial support, stressing that the development of a credible international financial centre requires a robust institutional framework and strategic investment partnerships.

The governor also emphasised the need to shield the project from political transitions, revealing that key state and federal institutions had been integrated into the implementation framework.

“We have designed a model that involves both state and national institutions so that the project becomes institutional rather than personality-driven. It is about building a sustainable structure that will outlive any administration,” he said.

Sanwo-Olu called for stronger synergy between the public and private sectors, noting that effective risk-sharing and joint investment strategies were essential to achieving the objectives of the LIFC.

In his remarks, British Deputy High Commissioner, Jonny Baxter, described the initiative as a major economic milestone capable of unlocking domestic and international capital flows for infrastructure development, job creation and overall economic growth.

He praised the Lagos State Government and EnterpriseNGR for driving the project and strengthening collaboration with federal institutions, adding that a well-structured international financial centre would deliver broad benefits to the national economy.

Also speaking, Co-Chairman of the LIFCC, Mr Aigboje Aig-Imokhuede, underscored the importance of private sector participation, describing the LIFC as a collaborative economic ecosystem that thrives on strong partnerships between government and business institutions.

He said EnterpriseNGR had played a leading role in advancing the initiative by drawing lessons from established global financial centres such as London, New York and Kigali.