Jim Ovia Never Endorsed ‘Wealth Bridge’ – Zenith Bank Disowns False Claims By Investment Scheme

Zenith Bank Plc has warned customers and the investing public to disregard fraudulent videos and images falsely linking its Group Chairman, Jim Ovia, to a high-return investment scheme being circulated online.

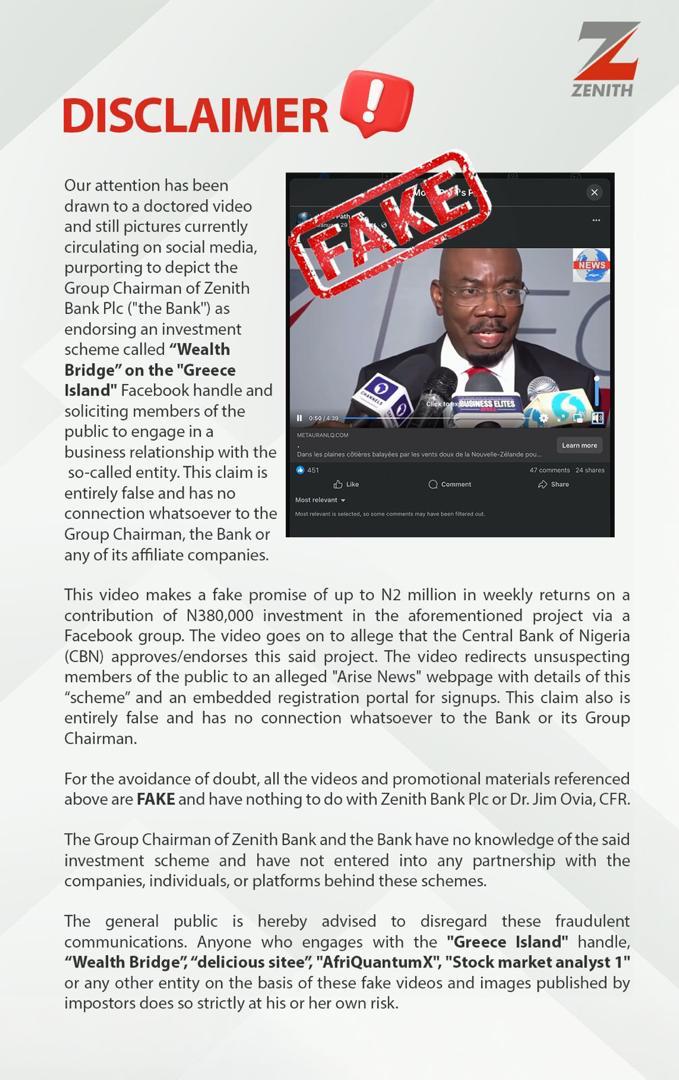

In a disclaimer issued by the bank, it said its attention had been drawn to “a doctored video and still pictures currently circulating… purporting to depict the Group Chairman… as endorsing an investment scheme called ‘Wealth Bridge’… and soliciting members of the public to engage in a business relationship with the so-called entity.”

The lender described the claim as baseless, stating unequivocally that it is “entirely false and has no connection whatsoever to the Group Chairman, the Bank or any of its affiliate companies.”

According to the bank, the promotional materials promise unrealistic financial returns and falsely claim regulatory backing. It said the video “makes a fake promise of up to ₦2 million in weekly returns on a contribution of ₦380,000 investment,” while also alleging endorsement by the Central Bank of Nigeria.

Zenith Bank dismissed these claims in their entirety, stating that “this claim also is entirely false and has no connection whatsoever to the Bank or its Group Chairman.”

The bank further warned that unsuspecting members of the public are being redirected to an alleged webpage styled to resemble Arise News content, complete with registration links for the scheme. It stressed that the webpage and related materials are fraudulent.

“For the avoidance of doubt, all the videos and promotional materials referenced above are FAKE and have nothing to do with Zenith Bank Plc or Dr. Jim Ovia,” the statement said.

The bank added that neither its leadership nor the institution has any involvement with the scheme, noting that “the Group Chairman of Zenith Bank and the Bank have no knowledge of the said investment scheme and have not entered into any partnership with the companies, individuals, or platforms behind these schemes.”

It urged the public to ignore the fraudulent communications and exercise caution, warning that “anyone who engages… on the basis of these fake videos and images… does so strictly at his or her own risk.”

The development underscores growing concerns within the financial services industry over the misuse of corporate identity and the manipulation of digital media to lend credibility to fraudulent investment offers, with institutions increasingly compelled to issue public disclaimers to protect customers and preserve trust. Read More