“Our focus must remain on price stability, the planned transition to an inflation-targeting framework, and strategies to restore purchasing power and ease economic hardship”

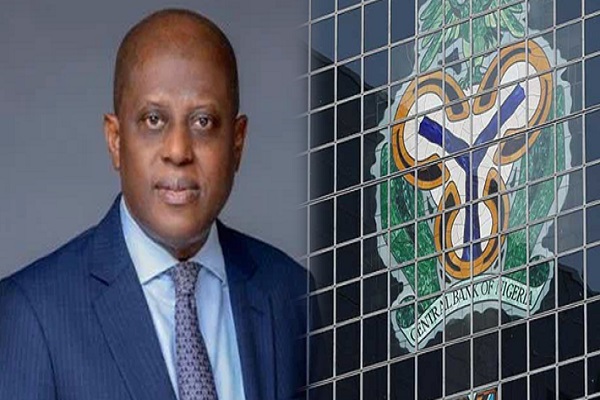

CBN Set to Curb Inflation, Stabilize Economy, Says Cardoso

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has announced the bank’s commitment to reducing inflation and stabilizing the nation’s economy. He made this statement in Abuja during the Monetary Policy Forum 2025, which included participation from fiscal authorities, legislators, private sector representatives, development partners, subject-matter experts, and academics.

In addressing the theme, “Managing the Disinflation Process,” Cardoso emphasized that the CBN’s goal is to maintain a monetary policy that is forward-looking, adaptive, and resilient. He reiterated the CBN’s commitment to a disciplined approach to monetary policy.

“Managing disinflation amidst persistent shocks requires not only robust policies but also coordination between fiscal and monetary authorities to anchor expectations and maintain investor confidence.

“Our focus must remain on price stability, the planned transition to an inflation-targeting framework, and strategies to restore purchasing power and ease economic hardship,” Cardoso said.

He stated that actions taken by the CBN have yielded measurable progress – relative stability in the FX market, narrowing exchange rate disparities, and a rise in external reserves to over $40 billion as of December 2024.

According to him, the apex bank is focused on strengthening the banking sector, introducing new minimum capital requirements for banks (effective March 2026) to ensure resilience and position Nigeria’s banking industry for a $1T economy.

“As we shift from unorthodox to orthodox monetary policy, the CBN remains committed to restoring confidence, strengthening policy credibility, and staying focused on its core mandate of price stability,” he stated.

He noted that the CBN launched the Nigeria Foreign Exchange Code, marking a decisive step forward for integrity, fairness, transparency and efficiency in our FX market. Read More