Most bank automated teller machines “ATMs” across the country are still dispensing old N1,000 and N500 notes, just four weeks before the deadline set by the apex bank, a report by Nairametrics revealed.

The old N1,000, N500, and N200 notes are set to be decommissioned by the end of January 2023, following the release of new currency notes by the Central Bank of Nigeria in December last year.

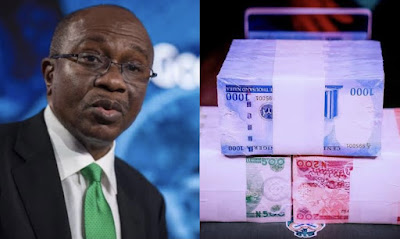

Recall that the CBN had in October 2022 announced the redesign of N200, N500, and N1,000 notes in a bid to curb currency counterfeiting and take control of the currency in circulation.

According to the CBN Governor, Godwin Emefiele, the new and existing naira notes will remain legal tender and circulate together until January 31, 2023, when the existing currencies shall seize to be legal tender.

“For the purpose of this transition from existing to new notes, bank charges for cash deposits are at this moment suspended with immediate effect. Therefore, DMBs must note that no bank customer shall bear any charges for cash returned/paid into their accounts.”

“Members of the public are to please note that the present notes remain legal tender and should not be rejected as a means of exchange for the purchase of goods and services,” the bank stated.

Meanwhile, several Nigerians have complained that most ATMs around are still dispensing old notes, with just less than four weeks to the deadline, while some others informed that they are yet to see or feel the new currency notes.

According to research, several ATMs across the country still dispense the old naira notes, the report said.

In several states in the South East, holidaymakers confirm old naira notes are still being dispensed in ATMs.

The same was observed in parts of the South West, North West States, and in the FCT, Abuja.

Findings made by Nairametrics also indicate the N1000 notes were the most commonly loaded to the ATMs and dispensed.

Just recently, the Nigerian Senate piled pressure on the Central Bank of Nigeria (CBN) to extend the deadline on old naira notes withdrawal from 31st January to 30th June 2023.

Senator Ali Ndume cited Orders 41 and 51 to seek the leave of the Senate to move a motion on the urgent need to extend the withdrawal of old currency from circulation.

Also, Senator Uzor Kalu also urged the CBN to go “as far as April ending to enable people to deposit their cash in banks.”

The House of Reps has also asked the CBN to halt the cash withdrawal policy (which is also tied to the introduction of new naira notes) and invited the CBN Governor (who was out of the country) to appear before it to explain the rationale for the move.

It is important to add that the Senate supported the introduction of new naira notes.

However, the Director of Currency of the Central Bank of Nigeria, Rasheed Adams, at a post-press briefing of the MPC meeting in November noted that there will be no deadline extension for the old notes, stating that the bank had received a sum of N165 billion of old notes as of November 2022.

According to the Central Bank’s countdown clock, which it launched on its website earlier in December, the current series of notes will seize to remain legal tender for 25 days. However, a major question raised by analysts is if the remaining 25 days will be enough to exchange the old notes with new ones.

READ New naira notes now in banks; ready for issuance, says Emefiele

The decision to maintain the short deadline is made on the back of significant naira hoarding, which is believed to be fuelling the surging rate of inflation in the country, already at a 17-year high despite monetary measures taken by the central bank.

In a bid to meet up with the deadline, the CBN told commercial banks to work on Saturdays.

CBN also told Nigerians in the diaspora that it will not be waiting for them to replace the old naira notes beyond the January 31st deadline.

Nonetheless, more old naira notes are still seen in circulation, raising a cloud of doubt over the deadline date of January 31st.

On the other hand, the CBN revealed its plans to reduce the volume of higher denominations in circulation, citing that the volume of N1,000 and N500 in the economy is fuelling Nigeria’s high inflation rate.

This informed the reduction of the daily maximum withdrawal limit for over-the-counter to N500,000 and N5 million for individuals and corporates respectively.

In the same vein, the apex bank also ordered banks to restrict ATM cash dispense to a maximum of N200 notes in order to reduce the volume of higher denominations in the economy.