An Abuja Magistrate Court has summoned former Senator Dino Melaye over alleged tax evasion exceeding ₦509 million. The FCT-IRS accuses him of defaulting on personal income tax for 2023 and 2024

FCT-IRS Drags Dino Melaye to Court Over Alleged ₦509m Tax Evasion

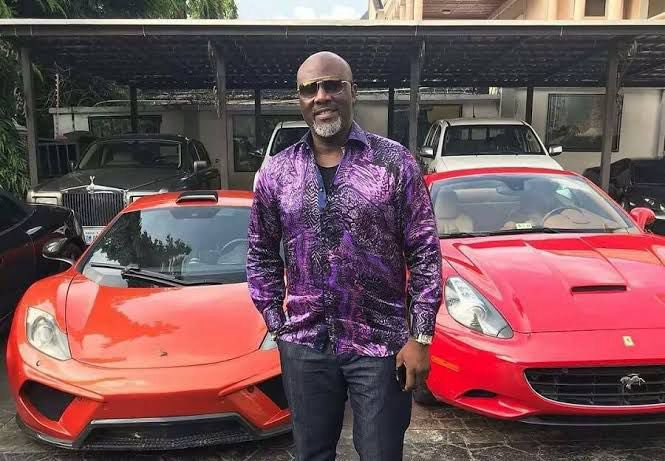

Former Kogi West Senator, Dino Melaye, is once again making headlines—this time for a serious allegation of tax evasion amounting to more than ₦509 million.

A Federal Capital Territory (FCT) Magistrate Court has ordered Melaye to appear before it on September 5, following a suit filed by the FCT Internal Revenue Service (FCT-IRS). The case is being presided over by Magistrate Chiemena Nonye-Okoronkwo.

According to filings, Melaye allegedly failed to pay his personal income taxes for 2023 and 2024, while also under-declaring his income in previous years. The FCT-IRS claims his tax payments have been “grossly inadequate” compared to his declared earnings.

Records presented by the agency show that Melaye paid ₦85,000.08 in 2019, ₦100,000.08 in 2020, ₦120,000 in 2021, and ₦1 million in 2022. Yet, in 2022, he reportedly declared over ₦6.5 million in income, far above what his tax remittance suggested.

Matters escalated in May 2025, when the FCT-IRS issued an administrative assessment for 2023 and 2024. After Melaye allegedly failed to respond, the agency issued a Best of Judgment (BOJ) assessment in June—slamming him with ₦234.9 million for 2023 and ₦274.7 million for 2024, bringing his total liability to ₦509.6 million.

In its formal notice, the tax authority stated:

“Despite reminders and ample time provided, your non-compliance with Section 41 of the Act constitutes a breach of your obligations.”

The summons is seen as part of Abuja’s wider push to enforce tax compliance among Nigeria’s political and business elite—a drive that has often been criticized for selective enforcement.

Whether Melaye’s flamboyant style will shield him or sink him in court remains a question only September 5 will answer. Read More