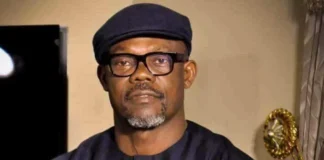

Babalola resigned his position due to “the rot, stench and corruption in the system”

Emerging details have revealed why Remi Babalola, former chairman of FBN Holdings Plc resigned as chairman of FBN Holdings.

Babalola who was appointed by the Central Bank of Nigeria following the abrupt exit of his predecessor, Oba Otudeko, is said to have resigned his position due to “the rot, stench and corruption in the system”, PREMIUM TIMES reports.

He announced his resignation and gave up the top board role at the financial service group on Friday.

READ ALSO: CBN approves Ahmad Abdullahi to succeed Babalola as FBN Holdings chairman

Although no official announcement has yet been made, including from the Nigerian Exchange Limited, according to information gathered on Friday.

The exit of Mr Babalola, a former Nigerian Minister of State for Finance, is coming at a time billionaire mogul Femi Otedola emerged as the new biggest shareholder at the holdco.

On Saturday, information gathered from top sources at the Central Bank of Nigeria (CBN) showed that the former minister claimed that he resigned amid frustrating attempts to reinstate confidence in the brand and improve corporate governance within the system.

In a letter announcing his resignation, the former chairman expressed frustration about the system and lamented his futile efforts to ensure transparency in the holdco’s operations.

“I accepted the appointment as a non-executive director and chairman of the board of FBN Holdings PLC on April 30th 2021 as a national call to service, an opportunity to deploy my endowments to illuminate humanity,” wrote Mr Babalola.

“Since then, it has been a slug of herd work, sacrifices and battles.”

Despite the challenges, Mr Babalola explained that the board was able to push through within the last few months to effect major changes in corporate governance overhaul. He noted that the board reinstated confidence in the brand, stalled value erosion, transferred registrars for transparency, introduced openness and due processes in all transactions, unveiled significant investors, and pushed for improved performance. (Premium Times)