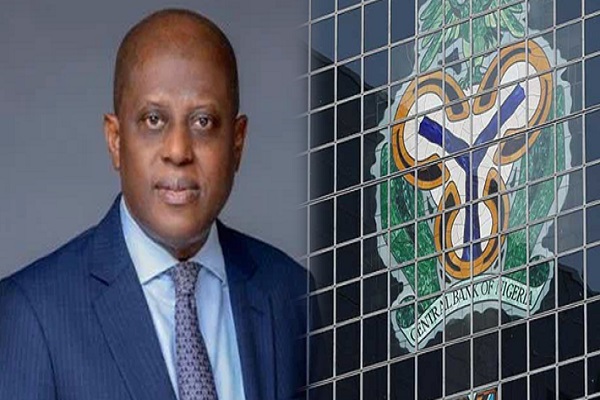

Cardoso stated that recent reforms were geared towards addressing distortions in the foreign exchange market.

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has reaffirmed that the remainder of the bank’s FX backlogs will be cleared in the next few days, most likely in a week and a half.

The Nigeria’s apex bank chief made this known during the Foreign Portfolio Investor call organised by the Nigerian Exchange Group (NGX) with the CBN team.

Cardoso stated that recent reforms were geared towards addressing distortions in the foreign exchange market.

While responding to questions on the current size of the FX backlogs and steps being taken to clear them, Cardoso said the CBN has cleared its FX backlog in all the banks except five and would do so in the next few days.

He said, “Basically what we have done with those is we have paid as much as we can to the point where we have cleared the backlog of all the banks save five. All the bank’s genuine and verifiable backlogs have been cleared save five.

“We are confident that we will shortly be in a position where the whole issue of forwards would be behind us. I would say in the next few days we should be in a position where the balance of the five would have been put behind us.

“I have tried as much as possible to be consistent on this matter. I don’t make promises I don’t fulfil. The last time I spoke on this matter, I was confident that within one month, we would be more or less out of it and I’m saying again that right now I think in the course of the next few days maybe a week and a half, this should be put behind us.”

During his confirmation hearing at the senate, the CBN Governor had emphasized the issue of clearing the FX backlog as one of his priorities.

In the past few months, the CBN has been able to clear a significant portion of its FX backlog in fulfilment of the Cardoso promise.

During the press briefing after the first MPC meeting of the bank, Cardoso said the bank cleared another $400 million of its FX backlog which going by estimates of the publicized clearance puts the remaining backlog in the region of $1.8 billion.