One of Nigeria’s leading fintech companies has deployed customer engagement software to set up an integrated support and CRM system.

Renmoney provides convenient loans, savings and fixed deposit products to Nigerians.

Last year, Renmoney delivered over 95,000 loans to individuals and small businesses via its website, contact centre, agent network and branches. The interactions across multiple channels created complexities that made it challenging to maintain a holistic view of each customer.

Freshworks customer engagement software provides Renmoney with a comprehensive view of customers contacting the business and a platform to leverage that information to personalize customer interactions across all channels. Before the integration, Renmoney relied on multiple tools for customer support and was looking to transition to one dedicated and dependable support and CRM tool.

The native integration that Freshworks offers between its CRM (Freshsales) and Support (Freshdesk) solutions ensure that Renmoney’s sales and support teams have a 360-degree view of their customers’ transactions and serve them better, with context.

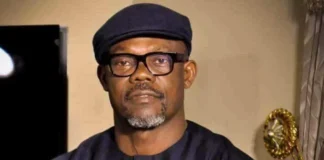

“Using multiple solutions to handle customer data was significantly affecting our ability to scale and serve more customers. We needed a solution that would meet our needs without introducing complexity,” said Oluwatobi Boshoro, CEO of Renmoney.

“With Freshworks, we have readily available CRM data which will allow us to achieve best-in-class customer support. We’re passionate about leveraging the best tools available to make our internal processes smoother while increasing convenience for our customers.”

“Having a 360-degree view of the customer is indispensable in the finance sector where multiple departments get in touch with the same user. Complete context is required, both by sales and support. Our products integrate with each other seamlessly and enable an all new level of customer engagement,” said Arihant Jain, Director for the Middle East and Africa, Freshworks.

Renmoney is a fintech lending company operating under a microfinance banking license in Lagos, Nigeria.

The company provides loans to individuals and small businesses via its website contact centre, agent network and branches. Renmoney offers market leading rates on Fixed Deposits and Savings and is regulated by the CBN and insured by the NDIC.

Freshworks provides customer engagement software to businesses of all sizes, making it easy for customer support, sales and marketing professionals to communicate more effectively with customers and deliver moments of wow.

Freshworks offers a full suite of SaaS (Software as a Service) products that create compelling customer experiences and lets businesses share a 360 degree view of relevant customer information internally.