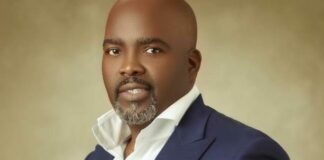

The acting chairman of the Federal Capital Territory Internal Revenue Service (FCT-IRS), Haruna Abdullahi, says FCT residents must present a tax clearance certificate to carry out certain transactions.

Mr Abdullahi said this at a town hall meeting organised by the FCT-IRS in Abuja.

The acting chairman said it would no longer be business as usual for residents, adding that obtaining car registration and building approval would no longer be possible without TCC.

According to him, other transactions that require TCC include appointment or election into office and stamping of guarantors form for a Nigerian passport, among others.

“This gathering is timely and relevant as we aim to provide guidance and insight on the need to demand and verify a TCC,” stated Mr Abdullahi. “This is as stated in the information circular issued by the service on November 4 and November 7 in newspapers within the FCT and national dailies across the country.”

The acting chairman urged FCT residents and relevant stakeholders to choose voluntary compliance over compulsion, noting that “it is imperative that a TCC is demanded as a pre-condition for various transactions in the FCT.”

He added, “It is also instructive to note that the law requires such from MDAs and commercial banks. Individuals and business owners residing in FCT can easily access a tax clearance through our effective and efficient channels.”

He said the failure of relevant agencies to demand and verify TCC presented by an individual could amount to sanctions (a fine of N5 million or three years’ imprisonment or both as stipulated by relevant tax laws).

According to Mr Abdullahi, the FCT-IRS, the relevant tax authority for Personal Income Tax (PIT) administrations, has a vital role in ensuring strict adherence.

(NAN)