South Africans cutting DStv cord as MultiChoice Struggles To Maintain Subscriber Base – Report

While MultiChoice said subscriber losses in the Rest of Africa were primarily to blame for the overall losses, DStv continues to bleed subscribers…

MultiChoice is struggling to maintain its DStv subscriber base, with years of price hikes making the pay-TV service expensive and unaffordable for many South African residents, a report by MyBroadband reveals.

The company’s annual results for the 2023/24 financial year revealed that it lost roughly 1.6 million DStv subscribers across all regions in which it operates.

While MultiChoice said subscriber losses in the Rest of Africa were primarily to blame for the overall losses, DStv continues to bleed subscribers in South Africa.

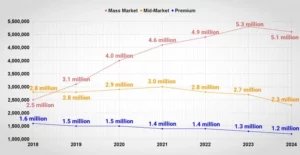

DStv splits active subscribers into three segments, with each representing a different set of DStv subscriptions as follows:

●Mass Market— DStv Family, Access, and EasyView subscribers

●Mid-Market— DStv Compact and Commercial subscribers

●Premium— DStv Premium and Compact Plus subscribersREAD ALSO: StarTimes condemns DSTV price hike, says it’s insensitive to Nigerians

Combined, the three segments lost roughly 700,000 subscribers in South Africa, with the mid-market segment seeing the most significant decline.

DStv Compact and Commercial subscribers in South Africa declined by approximately 400,000 between 1 April 2023 and 31 March 2024.

The segment had grown from 2.8 million subscribers in 2018 to 3.1 million in 2021, after which it has only seen declines.

The Mass Market segment showed strong growth from 2018 to 2023 before recording its first subscriber decline during the 2023/24 financial year.

The segment lost roughly 100,000 subscribers in South Africa between 2018 and 2019.

It lost a further 100,000 subscribers between 2021 and 2022 after remaining at 1.5 million South African users in 2020.

DStv’s premium segment lost approximately 100,000 South African subscribers between 2022 and 2023 and again between 2023 and 2024.

The chart below tracks DStv’s active subscriber losses across its mass-market, mid-market, and premium segments from 2018 to 2024.

Over the same period between 2018 and 2024, MultiChoice has hiked DStv prices by an average of 21% across all of its packages.

Interestingly, DStv’s most expensive package — Premium — has seen the lowest proportional price increase over the period at roughly 15%.

DStv Access customers have been the hardest hit, with prices increasing a whopping 40.4% from R99 in 2018 to R139 in 2024.

The only package that hasn’t been hit with any price hikes over the period is DStv EasyView, which has remained at R29 per month.

Many South Africans, frustrated with the constant price hikes and repeats on MultiChoice’s satellite TV packages, have said they only keep their DStv Premium subscription for the unmatched sports offering.

MultiChoice owns SuperSport, which has the rights to broadcast a wide range of sports events, including rugby, soccer, cricket, and motorsport, leaving limited other options for South African sports fans.

However, Canal+ Group Chair and CEO Maxime Saada said DStv will not start offering a sports-only package once under his company’s ownership.

For context, Canal+ has made a bid to buy the company outright for R125 per share after triggering the mandatory offer clause in the Companies Act when it exceeded 35% shareholding at the start of the year.

Canal+ had been gradually buying up MultiChoice shares, increasing its ownership in the local broadcaster after its creeping takeover of MultiChoice began in 2020.

It continued to buy MultiChoice shares after tabling its mandatory offer. In its latest public notice, Canal+ said it had acquired a further 7,374,918 shares in the DStv owner, bringing its total ownership of the local broadcaster to 45.20%.

Asked about the potential for sports-only and choose-your-own-channel packages once Canal+ takes over, Saada said everyone who has tried has failed.

He said there are only two aspects that drive subscriptions, namely, sports and discounted pricing.

Saada said Canal+ sees significant subscriber surges when there is a major upcoming sports event that people want to watch. However, he noted that the addition of one big movie won’t drive subscriptions.

Therefore, Canal+ won’t launch sports-only packages as it needs the draw of sports to drive subscriber growth for DStv’s existing packages

SOURCE: MyBroadband.Co.Za